Name the bank that does not get customer complaints of long waiting or unattended queries. Delays, complicated customer support, and unsatisfactory experiences are common issues with banks’ customer services. Well, no more!

With the rise of AI chatbots, customer support activities of banks are becoming easier than ever. A banking chatbot is now capable of managing all the customer interactions for your bank. It helps with customer engagement and notably improves functionality.

In fact, the global chatbot in BFSI (banking, financial services, insurance) market is projected to reach $6.83 billion by 2030 from $586 million in 2019. Today, banks are actively using chatbots to efficiently handle their customers’ queries and streamline essential and repetitive banking activities. With these faster and more automated solutions, there is no space left for complicated legacy systems.

So, let’s get into the world of banking chatbots, and talk about the key benefits and how you can use them for your banking system.

- Main Pain Points of the Banking Industry

- What are Banking Chatbots?

- Benefits of Banking Chatbots

- How to Use Chatbots for Banking?

- Wrapping Up

Main Pain Points of the Banking Industry

Before we talk about the benefits of banking chatbots, it is important to highlight the main pain points the banking industry faces currently related to customer service. Below are some of the main pain points in this perspective:

1. Unanswered Queries

Customer support representatives are often unable to solve queries due to a lack of information or words. This leaves many queries from customers unanswered.

2. Long Waiting Times

As money is a sensitive issue, customers want immediate attention from the banks to solve their problems. Days of waiting can be extremely frustrating, leading to poor customer satisfaction.

3. Varying Responses

Customer support representatives have inconsistent levels of knowledge, which makes customers struggle with varying responses.

4. Lack of Website Information

It is very common to see that most banks cannot provide sufficient information about their banks on their websites. Because of that, customers find it difficult to research and resolve their issues themselves.

5. High Support Queries Volume

With the growing customer base, banks have to deal with a high volume of support queries. This can become overwhelming and often leads to mismanagement.

6. Customer Dissatisfaction

With delayed actions, unanswered questions, and mismanagement, customers tend to get dissatisfied and leave poor reviews. It damages the reputation of banks and severely affects the ratings.

In short, the changing business dynamics and customer behavior urge banks to innovate their customer support services. This is where chatbots for banking play a crucial role.

Banking chatbots like VOC AI Chatbot help to automate the customer support process with your trained data. This helps to lower general support queries, automate assistance in basic banking activities, and reduce the burden of customer support representatives. With this quick overview, let’s now talk in detail about the banking chatbot technology.

What are Banking Chatbots?

In general, chatbots are advanced AI-powered programs that stimulate conversations with humans. Banking chatbots are programmed specifically to meet the needs of a banking system. These chatbots use Natural Language Processing (NLP) to imitate human conversations.

You can use a banking chatbot for your banking system to address customer queries 24/7 autonomously without the need for a human representative. For instance, if the customer has questions about account balances or recent transactions, a banking chatbot can provide quick and accurate responses. Similarly, the chatbot can help in updating personal information, activating or deactivating cards, and much more.

Banking chatbots use preprogrammed algorithms and learn from your provided data and previous user interactions. To replace the need for a human representative in the customer support service, they keep on learning and improving to provide the best experience for customers.

Benefits of Banking Chatbots

Banking chatbots aid banks and other financial institutions in multiple ways. Below are some of the key benefits of using banking chatbots:

1. Automated Customer Support

While all the banking staff cannot be available for customer support 24/7, the banking chatbot can serve the purpose. The banks that operate internationally find this extremely helpful due to the different time zones of different customers. This way, customers can get answers to their queries at any hour.

2. Reduced Costs

When the chatbot is handling most of the tasks, there is no need for a large customer service team. Chatbots not only answer queries but can guide users, monitor their transactions, and give suggestions. While the chatbot is doing such tasks, your reduced customer support team can work on more complex queries/tasks. Overall, this leads to significant cost reduction.

3. Personalized Customer Service

Based on users’ past interactions, the banking chatbot brings suggestions and solutions as per users’ preferences. First, it analyzes all the data saved from previous conversations and then provides personalized customer service.

4. Educating the Customers

For many people, financial products and bank policies are a little difficult to understand. Chatbots can help them learn about those products or policies and give answers to their specific questions regarding them. Apart from that, banking chatbots are also able to give a piece of financial advice or guidance for investments, which can drive sales.

5. Streamlined Banking Operations

Chatbots make banking more efficient by streamlining banking operations that might take hours to complete. Tasks like helping customers with their transactions, providing reports, and searching for specific details are all managed by the banking chatbot. This makes banking much easier for people as well as efficient for the banks.

6. Customer Sentiment Analysis

With daily customer interactions, the chatbot learns a lot about the customers’ attitudes, opinions, and what they expect from the bank. This data greatly helps in analyzing customer sentiment and improving your services to meet their expectations.

7. Improved Security

Banking chatbots are built with robust security measures in mind. Chatbots provide a safe and secure channel for customers to discuss their financial queries.

8. Scaling Up

As your bank eventually scales up, the chatbot can also intensify itself to manage the workload. So, you don’t need to hire more staff members, as the chatbot will make sure your customer service is up to the mark.

9. Sending Reminders

The capabilities of banking chatbots are not just limited to interacting with customers. They can also streamline activities related to sending reminders about payments, giving updates on credit scores, etc.

10. Upsell and Cross-sell

As the chatbot keeps monitoring the activities of the customer, it can recommend relevant products and services based on their interests and budget. This personalized marketing helps boost sales.

How to Use Chatbots for Banking?

There are many ways to use chatbots for banking. But the important thing to consider is which banking chatbot to pick. There are now plenty of banking chatbots to choose from. So, the choice mainly depends on what is your use case.

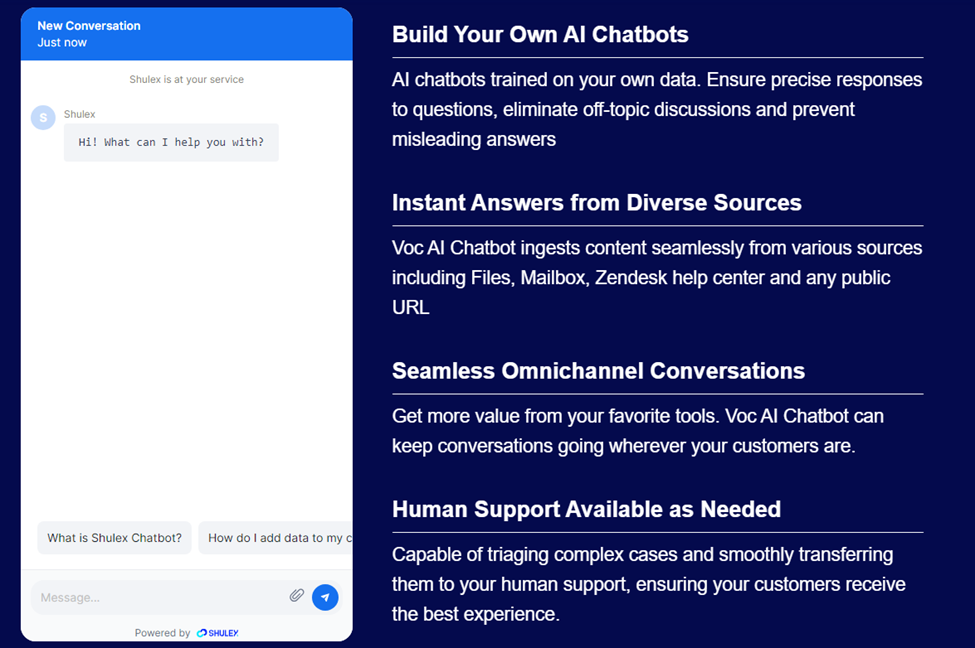

For instance, if you want to facilitate customers with FAQs or essential banking activities, then you can use Shulex VOC AI Chatbot. As the better alternative to Intercom, it comes with all the features you would need to set up a customer support chatbot for your bank. It is easily trainable with your data, can learn from interactions, and provides valuable insights, making it also an alternative to Zendesk.

Therefore, it is important to choose the right banking chatbot based on your use case. Besides that, below is a quick glimpse of different use cases of a banking chatbot, as follows:

1. Financial Advisory for New Customers

For customers new to banking, a banking chatbot is an excellent tool that your customers can use to take any financial advice at any time. The chatbot is well-trained to handle customers’ complicated queries and give them the right suggestions they need.

2. Facilitate Essential Banking Activities

A banking chatbot can facilitate customers in essential banking activities. This includes sending money, paying bills, knowing balance, answering FAQs, and more. Simply put, a chatbot can address all the general queries and automate essential banking activities.

3. Collect Customer Feedback

A banking chatbot helps to collect customer feedback efficiently without having to conduct surveys and interviews. Chatbots will engage with customers, gather their reviews, and present the data to you that will further help you to maximize customer satisfaction.

4. Send Reminders

It is not uncommon for customers to forget about paying bills, which can impact their credit score and make them pay additional charges. A banking chatbot can send customers reminders, which can be very helpful for customers and give you a competitive edge.

5. Facilitate Sales

A banking chatbot can also act as a salesperson. It can help promote products/services while engaging customers. Afterward, it can assist in applying for financial products and even support instant approvals.

6. Lead Generation

A banking chatbot is an incomparable source to generate leads. It knows how to engage customers in a conversation and personalize the experience for them. This way, it can facilitate generating leads and customer acquisition.

7. Detect Doubtful Activities

Despite efforts, security issues continue to persist. But a banking chatbot can fight them by sending alerts to your customers if any sign of suspicious activity appears. This helps them to take the necessary actions immediately or contact a human representative for further assistance.

In short, there are many applications of banking chatbots beyond just customer support. So, evaluate your needs, find the right chatbot, and begin optimizing your customer interactions.

Wrapping Up

Banking chatbots are the key to faster query resolution, reduced operational costs, and increased customer satisfaction. That’s why they are gradually becoming an integral part of banking operations. To wrap up, now is the time to embrace the transformative potential of chatbots in banking to revolutionize customer service.