Marketing is the key to driving businesses in the 21st century. On average, a company allocates 7.8 to 15.1% of its revenue on marketing tactics, depending on the business model. It’s a decent amount only if you are successful in acquiring enough customers who are ready to bring twice the ROI.

Thus, it’s important to keep a balance between the revenue generated by your business and the amount spent on acquiring new customers. This is where customer acquisition cost comes into action. This metric helps you determine the success value of your promotional efforts using a simple approach.

To ensure top-notch scalability of your business, it’s important to keep track of the customer acquisition cost and employ CAC optimization strategies. That said, let’s dig deeper into more about this metric, why it’s important, how to calculate, and other valuable details that are a must-know.

- What is Customer Acquisition Cost (CAC)?

- Why is CAC Important for Businesses?

- How to Calculate Customer Acquisition Cost?

- Examples of Customer Acquisition Cost

- Customer Lifetime Value (LTV) & Customer Acquisition Cost (CDC)

- How to Reduce the Customer Acquisition Cost?

- Wrapping Up – Expand Your Business Revenue By Optimizing CAC

What is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) is the total sales and marketing cost required to acquire a new customer. It tells a precise budget that your business needs to acquire and retain a new customer over a specific duration.

There are several factors that may influence this metric. For example, if your e-commerce setup is new, you will have to spend more on promotional campaigns, leading to a higher CAC. Contrarily, in the case of settled businesses, CAC is relatively lower unless you want to sell a brand-new product that your target audience does not know about.

Generally, a business should aim for an optimum customer acquisition cost to drive success. Too high of it indicates inefficient resource allocation, while a lower amount means you may miss out on reaching a handful of potential customers.

Why is CAC Important for Businesses?

The major reason why every business should prioritize their customer acquisition costs is the importance of low expenditure and high turnover. It’s obvious that if you are spending more than your revenue on acquiring new customers, you will soon go bankrupt.

Customer acquisition cost is a metric that, when used precisely, brings growth opportunities without breaking the bank. While it was neglected before due to complex calculations, digital solutions have made the tracking of these costs easier than ever.

Integrating customer acquisition cost in your current business model can help you in the long run, as follows:

- It helps to assess business expansion capabilities.

- Its data helps optimize the amount spent on acquiring new customers with quick ROI.

- It can provide comprehensive business intelligence when combined with other parameters.

In short, the intelligent use of CAC can have fruitful impacts on business growth in both the short and long term.

How to Calculate Customer Acquisition Cost?

Since customer acquisition cost is a crucial metric for financial stability today, it is important you get a solid grip on its mathematical calculation. Let’s dig deeper into this:

CAC is calculated by dividing the cost spent on acquiring new customers (sales + marketing) over a certain duration by the total number of buyers that were successfully acquired. You are free to choose a monthly, quarterly, or yearly time frame, depending on your business model.

To help better understand the customer acquisition cost formula, let’s take an example. Consider that your business marketing expenses last year were around $5,000. And in those 12 months, 200 new people started buying from your brand. According to the formula, the CDC would be $5,000/200=$25. This indicates you spent $25 on acquiring a single new customer.

What Marketing Costs Should be Included in CAC?

Now that we know how to calculate CAC, there might be a question in your mind: what marketing costs should you include in CAC?

Marketing campaigns encompass various strategies. Here are the major ones that you must consider when determining total expenses to calculate the customer acquisition cost:

- Paid advertisements on social media platforms, Amazon ads, SERP, etc.

- Software and tools used to research customers

- Salaries of the marketing staff

- Logistic costs associated with traditional ways of marketing, like printing and distribution of flyers

In short, all the marketing costs you are spending to grab the attention of new customers should be considered while calculating the customer acquisition cost. However, some businesses may not include salaries and logistic expenses depending on their objectives.

Examples of Customer Acquisition Cost

A CAC of any amount can either be good or bad for your company, depending upon various factors. To understand this better, let’s explore two examples to understand when CAC is good or bad:

Example 1: An Amazon Jewelry Seller

An Amazon seller who owns a jewelry store on Amazon spent $30,000 last month on their marketing efforts. They managed to acquire 1,000 new customers, leading to a $30 customer acquisition cost.

Is it a good figure, or does the store owner need to work on optimizing it? It certainly depends on the business’s average order purchase value and profit margin.

If each new customer spends $40 while purchasing from the store with a 20% profit margin, the business will certainly make $40,000 with $8,000 added to its revenue. This might seem like a lower profit, but if the store gets regular orders from new customers, the revenue will grow exponentially. Besides that, the business may then cut off marketing efforts, balancing the overall revenue.

Example 2: An E-commerce Garment Store

Our next example is an e-commerce garment store. Let’s assume that the business owner invested $30,000 in a month on its promotional, sales, and customer acquisition tasks. As a result, 1,000 new customers were convinced to buy from the store for the first time. It means around $30 was spent on every new purchaser (CAC).

Let’s suppose if a single customer spent $60 on average, the store earned $60,000 from 1,000 new customers. With a 30% profit margin, the business will have a solid increase of 18,000 in its revenue. In this scenario, a CAC of $30 is definitely satisfactory. However, it might not be the same case if the customer decides not to purchase from the store again.

Customer Lifetime Value (LTV) & Customer Acquisition Cost (CAC)

The customer lifetime value is the amount a consumer contributes to a company’s revenue by buying from it throughout his/her relationship with the brand. LTV’s ratio with customer acquisition cost is used to determine the expected value a consumer can bring compared with the amount spent on the acquisition.

To find out customer lifetime value, multiply the average revenue per user by their average lifetime. Once you get the answer, divide it by your business’s CAC. For example, if one consumer is forecasted to spend $200 on your business and you allocated $100 to acquire them, the ratio would be $200:$100 = 2:1.

This indicates you are in profit by earning two times more than the amount spent on marketing.

How to Reduce the Customer Acquisition Cost?

If the CAC of your business is higher than LTV, it will face a huge roadblock to success. However, it’s quite easier to bring it down by following the right strategies as listed below:

1. Opt For Organic Marketing Ways

You can utilize free channels as a source to spread the word about your business and attract more customers. This approach doesn’t require extra expenses and guarantees results if your content aligns with your business target audiences.

Here are some relevant ideas to implement:

- Create a blog and incorporate SEO tactics to get ranked organically

- Start podcasting associated with your brand

- Work on strengthening your social media presence

In short, identify all the free and effective marketing ways you can utilize and strategically use them for free customer acquisition.

2. Incorporate Live Chat on Your Website

Live chat can be your go-to solution for cutting down the cost of customer acquisition, as it’s a solid way of lead conversion. It allows your visitors to quickly interact with you and get answers to their queries. In fact, 79% of businesses have reported an increase in sales, loyalty, and revenue with live chat.

Through conversational engagement, you can turn visitors into loyal customers. However, it’s crucial to respond quickly and effectively, as the bounce rate is quite high in this case.

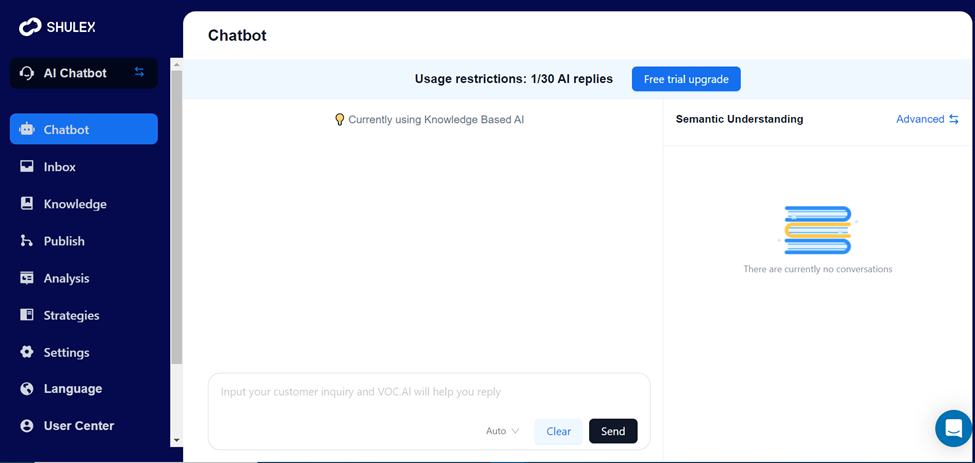

To give visitors rapid and convincing responses, you don’t have to hire experienced staff and pay them high salaries. Shulex AI Chatbot is an ideal companion here, as its GPT 4 empowered responses allow you to give personalized, compelling, and to-the-point responses to visitors’ queries. This way, you can get a competitive edge due to engagement with visitors, which eventually leads to more customers.

3. Streamline PPC Campaigns

Pay-per-click ads are a crucial part of CAC, and less expenditure on them can lead to lower acquisition costs. Optimizing these campaigns by targeting specific keywords, adding a creative touch to the ads, and other strategies can really help you cut down on expenses. You can also employ A/B testing or use PPC optimizer tools to launch profit-generating ads.

Wrapping Up – Expand Your Business Revenue By Optimizing CAC

Customer acquisition cost is an important metric to implement for businesses to ensure stable revenue generation without spending blindly. It helps determine whether the amount you’re spending on your marketing efforts would be able to bring you justified results or if you need to streamline it. To wrap up, aim for an optimum CAC, as you would be able to avail multiple growth opportunities while spending a limited budget for this purpose.